The year 2024 brought dynamic shifts across global financial markets, shaped by central bank policies, geopolitical developments, and economic trends.

Currencies saw significant volatility, with the US dollar dominating amid Federal Reserve rate cuts, while the Japanese yen and British pound struggled under dovish monetary stances. Metals posted mixed results as gold surged on central bank demand, but silver and copper faltered due to weak Chinese data. Energy markets saw natural gas thrive, while oil faced oversupply concerns. Cryptocurrencies shone with Bitcoin's remarkable rally, and equity indices reflected resilience, particularly in the tech-driven US markets.

Let’s explore the year-to-date performance of these key instruments as of December 23, 2024, and see what made this year one to remember.

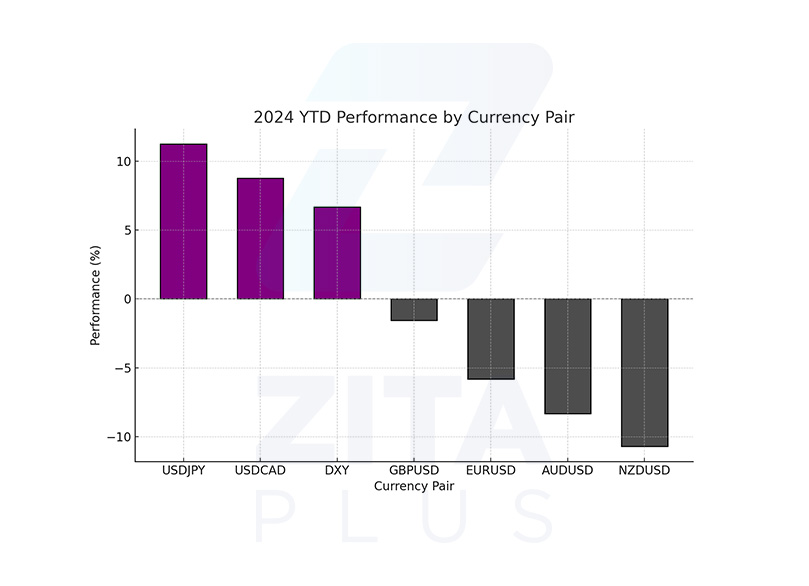

| Currency Pair | 2024 YTD Change (%) |

| USD/JPY | 11.25% |

| USD/CAD | 8.76% |

| DXY (Dollar Index) | 6.68% |

| GBP/USD | -1.57% |

| EUR/USD | -5.81% |

| AUD/USD | -8.33% |

| NZD/USD | -10.71% |

Throughout 2024, the Dollar Index demonstrated volatility, primarily influenced by the Federal Reserve's pivot to a more accommodative monetary policy and successive rate cuts. The year-end rally was further supported by market optimism following Donald Trump's re-election.

The Japanese yen emerged as the weakest performer among major currencies, with its depreciation driven by the Bank of Japan's sustained dovish stance, the absence of interest rate hikes, and a shift in fiscal policies under new government leadership.

In Europe, the euro faced downward pressure due to the robust strength of the US dollar, compounded by political instability and the underperformance of Germany, the Eurozone's largest economy.

The British pound closed the year in negative territory, as delayed monetary policy adjustments by the Bank of England, coupled with dovish guidance and anticipated rate reductions in 2025, weighed heavily on its valuation.

New Zealand's economy entering a technical recession, along with expectations for further monetary easing, positioned the NZD as one of the year's worst-performing currencies.

Both the Canadian and Australian dollars struggled amid fluctuating oil and metal prices, as well as the relative strength of the US dollar. Additionally, the Bank of Canada’s aggressive rate-cutting strategy, including four reductions during the year, accelerated the depreciation of these currencies.

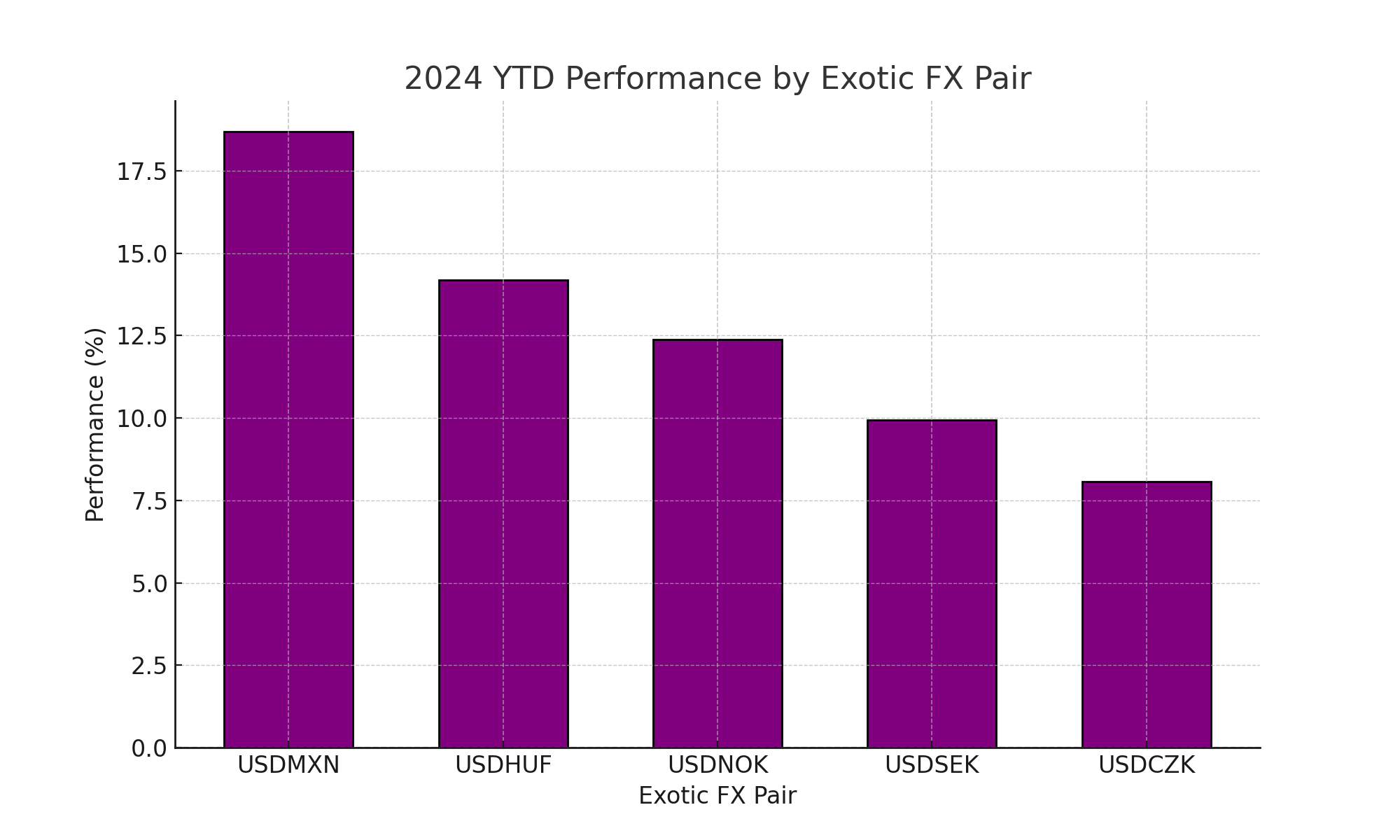

| Exotic Currency Pair | 2024 YTD Change (%) |

| USD/MXN | 18.69% |

| USD/HUF | 14.18% |

| USD/NOK | 12.38% |

| USD/SEK | 9.93% |

| USD/CZK | 8.08% |

The Mexican peso has depreciated by 18% this year. In addition to the strong dollar, the Central Bank of Mexico's four interest rate cuts and signals of potential further rate reductions have been key factors driving this decline.

The decline in the Norwegian krone was largely triggered by the strong dollar. Despite no changes in interest rates, low inflation, and higher wage growth, the Norwegian krone is set to close the year with a roughly 12% loss in value.

| Metal | 2024 YTD Change (%) |

| Gold | 26.89% |

| Silver | 24.75% |

| Copper | 4.48% |

| Platinum | -5.06% |

The metals sector recorded overall positive performance in 2024, with gold leading the way. The Federal Reserve's interest rate reductions served as a key driver, while sporadic geopolitical events provided further upward momentum. Central banks' increased gold reserves significantly bolstered demand.

Divergences within the sector were evident. Silver and copper were adversely impacted by weak economic data from China, the world's largest consumer of industrial metals. This dampened demand expectations, particularly for silver, widely used in industrial applications.

Platinum experienced negative growth, with demand restrained by the economic slowdown in China and the automotive industry's shift toward electric vehicles. Prolonged weakness in demand may limit price recovery in the near future, even with potential production cuts in 2025.

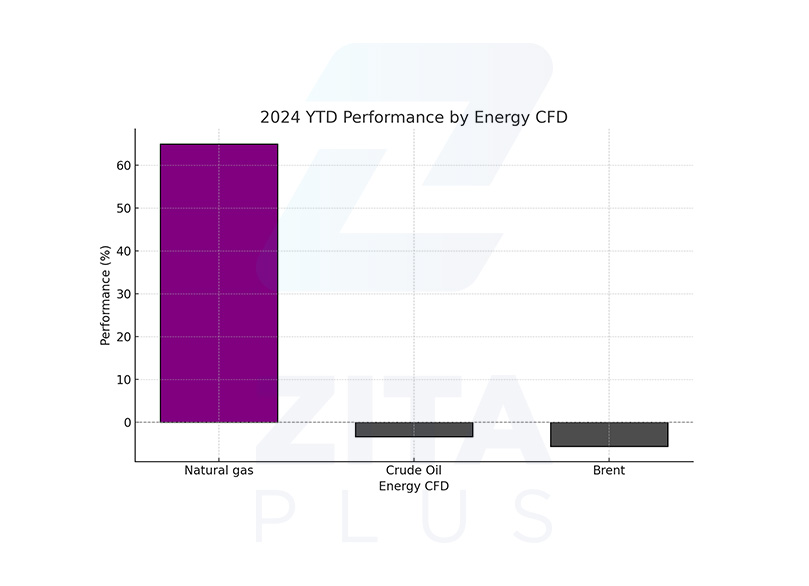

| Energy CFD | 2024 YTD Change (%) |

| Natural Gas | 64.95% |

| Crude Oil | -3.34% |

| Brent Crude | -5.62% |

Natural gas emerged as the standout performer in the energy sector, driven by strong global LNG demand and diminishing prospects for continued pipeline imports from Russia via Ukraine. Conversely, crude oil and Brent prices faced downward pressure amid oversupply concerns and uncertain demand outlooks.

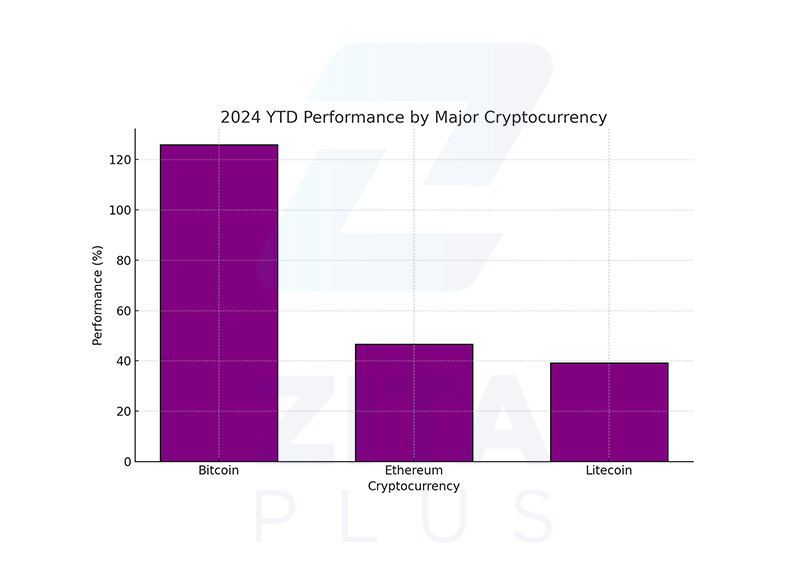

| Cryptocurrency | 2024 YTD Change (%) |

| Bitcoin | 125.93% |

| Ether | 46.61% |

| Litecoin | 39.22% |

The cryptocurrency market experienced remarkable gains in 2024, led by Bitcoin’s triple-digit rally. The sector benefited from the Federal Reserve's monetary easing and renewed investor confidence, partially spurred by the anticipation of political stability under Donald Trump's administration.

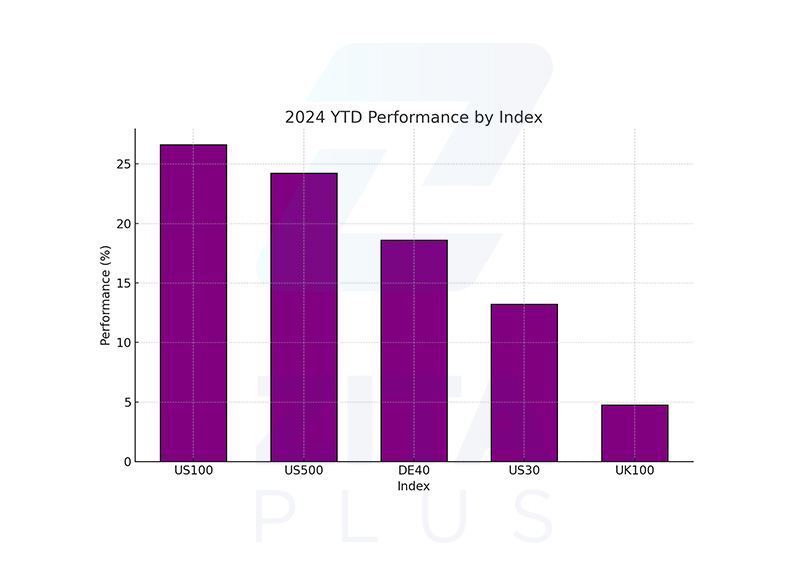

| Index | 2024 YTD Change (%) |

| US100 | 26.61% |

| US500 | 24.21% |

| DE40 | 18.59% |

| US30 | 13.21% |

| UK100 | 4.75% |

Global equity indices delivered a strong performance, largely supported by central banks’ policy shifts toward interest rate cuts. US indices such as the Nasdaq and S&P 500 led the charge, reflecting the resilience of the tech sector. However, European and UK indices lagged behind, reflecting regional economic challenges and slower recovery momentum.

Would like to learn how to look financial markets from a different angle? Then keep reading and invest yourself with ZitaPlus.