These concepts are used to understand broader trends, uncover valuation imbalances, and identify where capital might flow in global markets. While they might feel abstract at first glance, traders who understand these ideas can better evaluate whether a currency is relatively strong or weak, and why it might stay that way.

Let’s say you’re subscribing to a streaming platform. In the US, a premium plan might cost $15. In India, that same service could be available for the equivalent of $4. While the digital product is identical, the same shows, same interface, the price varies to reflect the average income and cost of living in each country. That pricing strategy is rooted in Purchasing Power Parity logic.

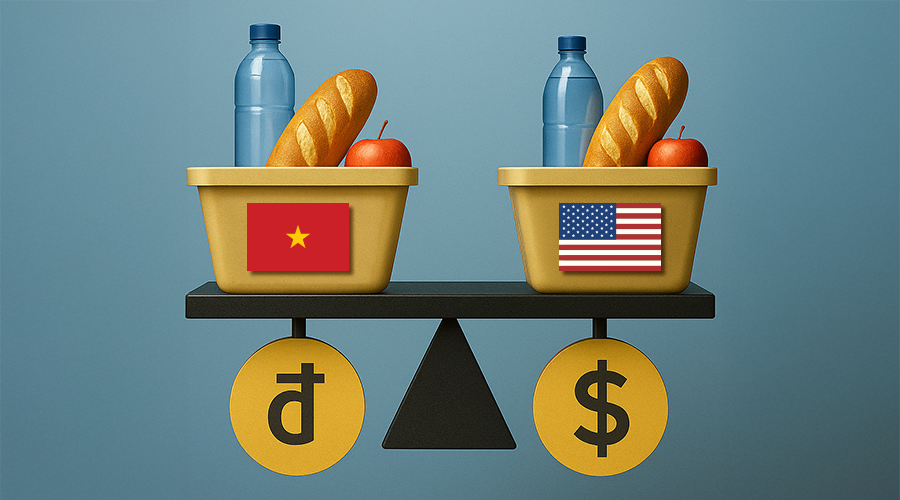

Purchasing Power Parity, or PPP, is a theory that compares the value of currencies through the cost of goods. At its core, it asks a simple question: If two countries sell the same product, should it cost the same once you convert the prices to a common currency?

The idea is that in the long run, exchange rates should adjust so that identical goods cost the same in different countries. If a basket of products is consistently cheaper in one country than another, that country's currency may be undervalued, and PPP theory suggests it could appreciate over time.

There are two main forms of PPP:

PPP is closely linked to inflation. If one country experiences higher inflation than another, its currency should theoretically weaken to reflect the loss in purchasing power. That’s why long-term shifts in price levels often show up in currency valuations.

Purchasing Power Parity isn't something traders check every day, but it can shape how you view a currency’s long-term direction. It works best as a macro framework, helping you identify whether a currency is fundamentally cheap or expensive relative to another.

Here’s how traders use PPP in practice:

That said, PPP is not a timing tool. Currencies can remain overvalued or undervalued for extended periods. Geopolitical risk, capital flows, and market sentiment often override these valuations in the short term.

For traders with a long-term view, PPP offers a structured way to think about value. But for execution, it’s best paired with more immediate indicators and price-based setups.

To make Purchasing Power Parity easier to understand and compare, several organizations and publications have created indices that reflect real-world price differences. Here are three of the most well-known:

Published by the OECD, this index compares the price levels of goods and services across member countries, adjusted for exchange rates. It’s a broad tool used to assess whether countries are relatively expensive or cheap, helping economists and policymakers evaluate currency valuation, cost of living, and wage comparisons.

Introduced by The Economist, this index uses the price of a McDonald’s Big Mac in different countries to measure currency misalignment. Since the burger is standardized globally, large price differences (after converting to a common currency) may indicate whether a currency is over- or undervalued based on PPP.

Created by The Economist’s Africa bureau, this index applies the same concept as the Big Mac Index but focuses on African countries, where KFC is more widespread than McDonald’s. It compares the price of a bucket of chicken across markets to evaluate currency purchasing power.

These tools don’t replace formal models, but they offer accessible, practical insights into PPP in action and help highlight long-term pricing imbalances in a way that’s easy to grasp.

Interest Rate Parity (IRP) is a theory that explains how differences in interest rates between two countries influence exchange rates, especially in forward markets.

The idea is simple: if one country offers higher interest rates than another, the difference should be reflected in the forward exchange rate. This prevents arbitrage opportunities, where traders could otherwise profit from interest rate gaps without taking on currency risk.

There are two main types of IRP:

For traders, understanding IRP is a must when looking at carry trades, forward pricing, or evaluating how central bank policy may shift capital between economies. However, IRP doesn’t always hold perfectly in the real world. It can break down due to:

In theory, these models help explain why money moves across borders and how those flows affect exchange rate expectations. IRP doesn’t predict currency direction, but it helps define what the forward rate should be if interest rate differentials hold.

Let’s look at a simplified historical example involving the US dollar (USD) and the Japanese yen (JPY) in early 2022 to see how Interest Rate Parity works in real market conditions.

The Setup

In January 2022, the US Federal Reserve had signaled rate hikes, while the Bank of Japan maintained ultra-low rates.

Applying Covered Interest Rate Parity

According to IRP, the forward exchange rate should reflect the interest rate differential:

The actual forward rate was extremely close to this theoretical value, showing that IRP held in this case. There was no arbitrage opportunity; the higher US interest rate was already priced into the forward market.

Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) both explain currency movements, but they approach the market from different angles and operate on different timelines.

What Each Theory Focuses On

Time Horizons

How Traders Use Them

Both theories offer structure, but they don’t always point in the same direction. One may show a currency as undervalued, while the other suggests capital outflows due to lower yields.

Economic theories like Purchasing Power Parity and Interest Rate Parity might not drive day-to-day price action, but they continue to shape the foundation of how we understand currency value and movement. These models help explain the logic behind capital flows, long-term valuation, and forward pricing, concepts that remain highly relevant, especially in uncertain macro environments.

Use theory where it applies, but combine it with price data, sentiment, and risk awareness. Currency markets are influenced by many forces, but when theory and market conditions align, opportunities can be fruitful.

Would like to learn how to look financial markets from a different angle? Then keep reading and invest yourself with ZitaPlus.