The recent conflict between Israel and Iran, along with other ongoing tensions like Ukraine and Russia or Armenia and Azerbaijan, are clear examples.

When a war starts, it often leads to higher prices, supply problems, and fast changes in government spending, also effecting the consumer spending directly. This situation is called a war economy.

In this article, we’ll explain what that means, how it affects different sectors, and what traders should watch in various markets.

A war economy is when a country’s financial system shifts to support or adapt to the ongoing conflict. Normal economic priorities take a back seat, and governments focus more on military spending, emergency programs, and securing key resources. Factories may stop producing consumer goods and start making weapons or military supplies. Trade routes may be blocked, and imports or exports can be heavily restricted.

In this type of economy, the goal is not just growth or stability. It’s survival. Governments often take more control over industries, prices, and even the labor force. Everyday life changes, too. People may face shortages, rising prices, and changes in jobs or income as the country adjusts to wartime conditions.

The impact is not limited to the war zone. Global markets react quickly, especially when the conflict involves major exporters or important trade routes. As a result, the effects of a war economy can reach far beyond the countries directly involved.

War often forces governments to spend more than usual. Military operations, emergency aid, and rebuilding efforts require large amounts of money. To cover these costs, countries may increase borrowing, print more money, or shift budgets away from public services. This can quickly lead to budget deficits and rising national debt.

At the same time, inflation usually rises. When supply chains break and goods become harder to get, prices go up. If a war leads to oil or food shortages, even countries not involved in the conflict feel the impact. Energy costs tend to spike and drag other prices up with them.

Central banks might respond by adjusting interest rates or stepping in to control the local currency. But during war, these actions are harder to manage, especially if investors start pulling their money out of the country.

Everyday consumers might choose to boycott certain brands in order to take a stance against one of the parties of the war, shaping the overall financial sentiment. Many occasions show that people all over the world practice produce boycott to stand in soliditary for the victims of the war.

Embargoes and sanctions also add pressure. Countries involved in a conflict may face export bans on key products like oil, gas, weapons, or technology. For example, Russia has faced major sanctions since the start of the Ukraine conflict, cutting off access to global finance and trade.

Similar restrictions have hit Iran over the years, limiting its ability to sell oil or buy advanced goods. These limits don’t just hurt the target country; they also affect global supply chains and investor confidence.

As a result, macroeconomic stability weakens. Inflation rises, currencies fluctuate, and long-term planning becomes difficult. For traders, these periods are full of risk but also opportunity.

War doesn’t affect every part of the economy the same way. Some sectors grow rapidly because they support military efforts or meet urgent needs. Others slow down or even collapse due to supply problems, low demand, or risk exposure. Below is a look at which sectors tend to benefit and which ones often suffer during war periods.

1. Defense and Arms Manufacturing

Governments increase military spending. Companies that produce weapons, vehicles, drones, or ammunition often receive large contracts.

2. Energy (Oil and Natural Gas)

Conflicts, especially in oil-rich regions, create fears of supply cuts. This pushes prices higher. Energy companies often benefit from the price surge, even when they are not based in the conflict zone.

3. Precious Metals and Mining

Gold, silver, and platinum are seen as safe stores of value during uncertain times. Demand rises, and mining firms usually gain investor interest.

4. Cybersecurity and Technology Infrastructure

Modern conflicts involve more digital threats. Companies that provide secure communication, data protection, or infrastructure support often see a rise in demand.

5. Logistics and Transportation of Essentials

Military operations require food, fuel, and supplies. Shipping, freight, and local transport companies that support these efforts can benefit.

1. Tourism and Aviation

Travel warnings, canceled flights, and border closures hit tourism hard. Airlines, hotels, and travel agencies often report major losses during prolonged conflicts.

2. Consumer Goods and Retail

When uncertainty rises, people spend less on non-essential items. Retailers and consumer brands may struggle, especially in regions close to the conflict.

3. Agriculture and Food Production

In some wars, farmland becomes unsafe or unusable. Labor shortages, fuel costs, and disrupted transport can all hurt food supply and cause prices to rise.

4. Tech Startups and Export-Heavy Businesses

Smaller firms that rely on imports or foreign sales may face delays, contract issues, or loss of demand. Sanctions or embargoes also block access to global markets.

5. Finance and Banking in Conflict Zones

Local banks often see sharp withdrawals, falling credit activity, and rising risk. If a country faces sanctions, its banks may also be cut off from international systems.

When war breaks out, governments are forced to act fast. Their main goal is to keep the country running while supporting the military and managing public needs. This usually means big shifts in spending, trade policy, and economic control.

Military expenses rise quickly. Governments often pour money into weapons, vehicles, and soldier support. This funding usually comes from emergency budgets, loans, or by cutting spending in other areas like education or infrastructure.

In addition to military needs, governments also create support programs for civilians. These can include food subsidies, fuel price caps, rent freezes, or direct cash payments. The goal is to keep public morale stable during tough times and reduce the risk of social unrest.

War often leads to pressure on a country’s currency. People and businesses may try to convert local money into safer foreign currencies, which weakens the exchange rate even more. To prevent this, governments may introduce capital controls.

These controls can include limits on international money transfers, restrictions on foreign exchange purchases, or forced currency conversion for exporters. In extreme cases, governments may freeze bank withdrawals or close forex markets temporarily.

Many countries maintain reserves of key resources like oil, natural gas, grains, and medical supplies. During war, these reserves become critical. Governments may release stockpiles to control prices or avoid shortages.

At the same time, they may set national production targets for essentials like fuel, food, and medicine. Some countries introduce rationing systems to make sure everyone gets basic goods, especially when supply chains are damaged.

War often leads to strict control over what can be imported or exported. Governments may ban the export of certain goods like fuel, food, or electronics. They may also block imports from specific countries due to security risks or international pressure.

Embargoes can work both ways. A country may face trade bans from others, which limit its ability to get parts, raw materials, or advanced technology. This can damage entire industries and lead to black markets or smuggling.

To fund the war, some governments increase taxes; especially on higher income groups or luxury items. Import duties may also go up, particularly on non-essential goods.

In many cases, governments issue war bonds. These are investment products sold to the public, with the promise of future repayment. War bonds help raise quick capital and are often promoted as a patriotic duty during conflict periods.

War often triggers inflation. Supply chains break down, transport routes get blocked, and the cost of raw materials goes up. When goods like fuel, food, or metals become harder to find, their prices rise. These increases quickly spread to other areas of the economy, from electricity bills to supermarket shelves.

Governments may try to control inflation by fixing prices or offering subsidies, but these measures don’t always work long term. When a war drags on, inflation tends to get worse, especially if the country relies on imports or is under sanctions.

At the same time, currencies in war-affected regions usually weaken. Investors move their money to safer countries, and locals often try to exchange their savings for stronger foreign currencies. This puts pressure on the local exchange rate. In some cases, central banks step in to protect the currency by using reserves or changing interest rates.

Global investors tend to move toward safe-haven currencies during conflict. The US dollar (USD), Swiss franc (CHF), and Japanese yen (JPY) are common choices. These currencies often strengthen when global risks increase.

For traders, it’s important to watch inflation trends and currency moves closely during war periods. Shifts can be fast and sharp, creating both risk and opportunity across forex pairs and commodity-linked currencies.

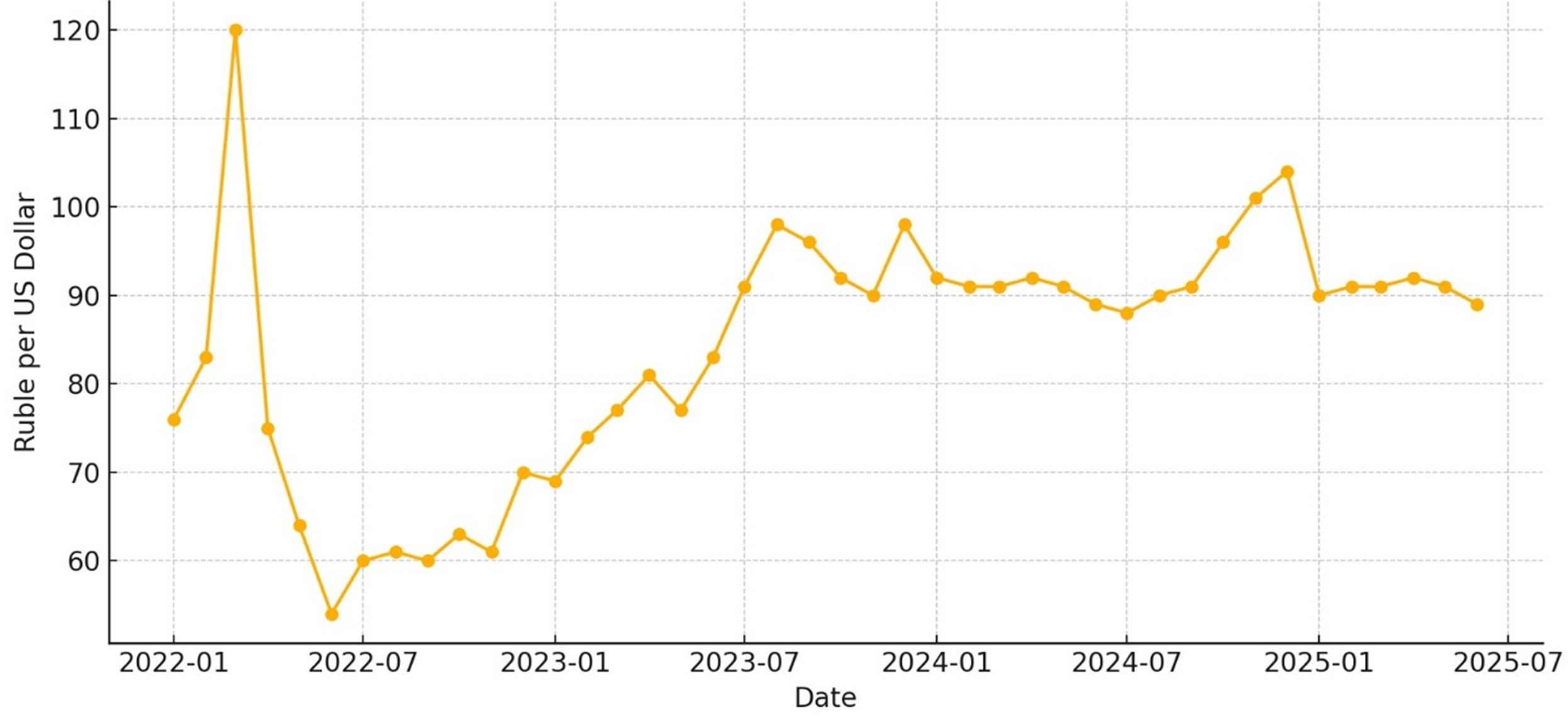

The chart shows how sharply the rouble collapsed to a record low of around 120 per dollar right after Russia’s full-scale invasion of Ukraine in March 2022, reflecting panic selling and the first wave of Western sanctions.

Swift capital-controls and the surge in energy export revenues then helped the currency rebound below 60 by June 2022.

From mid-2023 onward, new sanctions, a wider budget deficit, and softer oil prices pushed the rouble steadily weaker again, briefly topping 100 in late 2023 before the authorities raised rates and re-introduced tighter FX rules. By mid-June 2025 it trades around 78–79 per dollar, still well above pre-war levels but far from the extremes seen in 2022

During times of war, commodities often react faster than most other markets. Traders move their money into physical assets when uncertainty rises, and demand spikes for key resources tied to energy and defense.

Prices don’t just move because of supply and demand. They move because of fear, protection strategies, and political risk.

Conflicts that involve major oil producers, transport routes, or resource-rich regions usually cause immediate price swings. Supply chains get disrupted, and investors look for safety in hard assets.

Gold is the most common safe haven during war. Investors turn to it when they lose confidence in currencies or want to escape volatility in stocks and bonds.

During almost every major conflict in modern history, gold prices have surged; especially when war involves economic sanctions or currency risks.

Silver often follows gold’s lead, though it has more industrial use, so it can react differently in mixed economic situations.

Platinum is less commonly traded by retail investors, but it's used in both industry and defense-related production, which makes it sensitive during wartime.

When geopolitical tension rises, metals markets usually see higher volumes, wider spreads, and stronger price action. Central banks also tend to increase their gold holdings, adding to the upward pressure.

Oil is often the first commodity to spike in price during a war, especially if the conflict affects production or key shipping routes like the Strait of Hormuz. Even the risk of supply disruption is enough to drive prices higher, as traders try to price in worst-case scenarios.

Natural gas is highly sensitive, too. Particularly in regions like Europe, which relies on cross-border pipelines. The Russia–Ukraine conflict showed how quickly gas prices can jump when flow is restricted.

Other commodities like wheat, corn, and industrial metals can also be affected. War in farming regions reduces food supply, while metals used in manufacturing or defense become more valuable.

Conflicts that hit global supply chains, like semiconductor production or lithium mining can send ripple effects across tech and battery industries as well.

Trading during wartime is not business as usual. Market reactions can be sudden and driven more by headlines than by charts or economic data.

1. Focus on Safe-Haven Assets

When tension rises, traders often shift toward gold, the US dollar, and sometimes the Swiss franc or Japanese yen.

2. Watch Energy and Metals Closely

Oil, gas, and precious metals are typically the most reactive during war periods. Prices can swing sharply due to sanctions, pipeline risks, or production cuts.

3. Expect Volatility and Wider Spreads

Liquidity can dry up fast in uncertain times, especially in exotic currency pairs or less-traded commodities. Use smaller position sizes, set wider stops if needed, and avoid overtrading.

4. Stay Informed, Not Overloaded

News drives the market during war. But avoid reacting to every headline or news from any source.

5. Reassess Risk Management

Hedging with commodities, defensive stocks, or short-term options might help during periods of sharp correction.

6. Don’t Ignore the Bigger Picture

Some wars escalate quickly, while others last for years. Keep an eye on the macro path; things like rising inflation, slowing global trade, or central bank shifts in response to conflict.

War economies are shaped by pressure, urgency, and unpredictable change. They affect how governments spend, how businesses operate, and how global markets move.

From rising inflation and volatile currencies to sudden shifts in oil and gold prices, war leaves a deep footprint across every sector.

For traders, these periods require a sharper focus, better risk control, and the ability to react quickly when the landscape changes.

It’s just as important to remember that no crisis lasts forever. Markets eventually adjust, and periods of conflict are often followed by recovery, rebuilding, and a return to more stable conditions.

Would like to learn how to look financial markets from a different angle? Then keep reading and invest yourself with ZitaPlus.